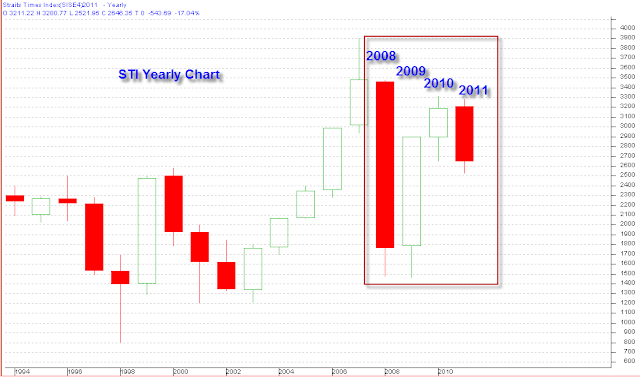

The end of year window dressing did not happen at all as expected. STI closed 26 points down at 2646.35 today. That's the 2011 year end close figure for STI. As for the whole year, STI dropped 543.69 points or 17%.worst year since 2008 financial crisis.

For a trader, winning is extremly dangerous if you haven't learned how to monitor and control yourself.

The Secret Recipe: Trading Success = Winning Trading System - U

The Secret Recipe: Trading Success = Winning Trading System - U

Friday, December 30, 2011

Last Day to Close 2011

Good morning.

It's our last trading day today to close book. STI managed to close higher yesterday at 2672.78, up by 6.53points. Slightly above its 61.8% fibo level at 2669. The trading volume has picked up slightly as well. The next fibo level in sight is 50% at 2714, which is its downtrend line resistance level. With US market up by 135 points last night, I'm watching STI for a rebounce today with upside capped at 2715.

It's our last trading day today to close book. STI managed to close higher yesterday at 2672.78, up by 6.53points. Slightly above its 61.8% fibo level at 2669. The trading volume has picked up slightly as well. The next fibo level in sight is 50% at 2714, which is its downtrend line resistance level. With US market up by 135 points last night, I'm watching STI for a rebounce today with upside capped at 2715.

Wednesday, December 28, 2011

STI Update

Goood morning everyone. I just came back Singapore four hours ago in this morning. A enjoyful holiday for me. Hope you all had a great Christmas too.

We have three more days to close book of 2011. Market is still trapped within 2670-2680, the whole market volume is very thin-- 370m for yesterday only( compare to normal 1.1B). Market is quiet ahead of New Year.

Look at chart below, STI is just above 61.8% 2668, it may test 50% at 2714 level in coming days, a pretty much short rebounce is expected but nothing much higher, for now.

We have three more days to close book of 2011. Market is still trapped within 2670-2680, the whole market volume is very thin-- 370m for yesterday only( compare to normal 1.1B). Market is quiet ahead of New Year.

Look at chart below, STI is just above 61.8% 2668, it may test 50% at 2714 level in coming days, a pretty much short rebounce is expected but nothing much higher, for now.

Friday, December 23, 2011

Merry Christmas

Merry Xmas to all my dear readers.

The market trading volume is extremely thin these days approaching holiday season. The average trading volume on the whole market is about 450m from the normal 1.1b... Anyway I'm going out of town later for my holiday and will be only update you on 28th Dec again. See ya.

The market trading volume is extremely thin these days approaching holiday season. The average trading volume on the whole market is about 450m from the normal 1.1b... Anyway I'm going out of town later for my holiday and will be only update you on 28th Dec again. See ya.

Thursday, December 22, 2011

ChinaAoil

A dimond in the rough? ChinaAoil ( CAO) has broken its long term downtrend line (blue line, see below chart.)

Major support is 97.5c, which is above its 20ma and 50ma as well. The chart looks nice, good entry point will be at 97.5c to 98.5c.

Major support is 97.5c, which is above its 20ma and 50ma as well. The chart looks nice, good entry point will be at 97.5c to 98.5c.

Long candidate: Genting SP

Genting Sp well supported by its 20ma at 1.52 with bullish MACD and increasing volume.

Current price at 1.53, near term target 1.62( gap). Stop loss: 1.48.

Current price at 1.53, near term target 1.62( gap). Stop loss: 1.48.

Wednesday, December 21, 2011

STI Outlook

Last night Dow up by 337.3 points to closed at 12103, regain control over 12000. STI has dropped to near 2600 since it broke its uptrend line. It likely to rebound to test the level at 2670-2694 area again in coming days. Christmas rally to come?

kepcorp

Sembmar

CAO

Goldenagri

NOL

Monday, December 19, 2011

STI Outlook Gloomy

Good morning everyone. Sorry for my inactive in updating my blog last few days. I'm a bit of annoyed by the bearishness of the market. And I can't short it due to the temporary unavailable of CFD trading, the good news is Kim Eng is taking the opportunity to fully revamping the CFD platform and is expected to start brand new in year 2012.

In any case, Christmas is just on the corner and we have two weeks to end the year 2011. Are we going to have a rally towards year end? The odds seem getting slim. So far the market looks still weak, look at the chart below, STI triangle uptrend line has been broken, the 61.8% fib support level 2668 also been broken at the same time. On last Thursday it actually did gap down below this level, and managed to had a rebounce to filled the gap( Friday's high is 2667.38), 2668 support turns to resistance level now.

For this week, I'm watching 2640 as STI's immediate support closely, once it closed below 2640, more downside shall come.

In any case, Christmas is just on the corner and we have two weeks to end the year 2011. Are we going to have a rally towards year end? The odds seem getting slim. So far the market looks still weak, look at the chart below, STI triangle uptrend line has been broken, the 61.8% fib support level 2668 also been broken at the same time. On last Thursday it actually did gap down below this level, and managed to had a rebounce to filled the gap( Friday's high is 2667.38), 2668 support turns to resistance level now.

For this week, I'm watching 2640 as STI's immediate support closely, once it closed below 2640, more downside shall come.

Wednesday, December 14, 2011

STI on the Edge of Cliff

Take a look at STI chart below, it's now cycling down to its triangle bottom line, I'm bearish if STI can't CLOSE above 2715( 50% Fib level), more down side if it closed below the triangle bottom line, "last straw" is at 2668( 61.8% fib).

Look at the STI line chart below, I have the below pivotal levels(close price) on my notes:

Immediate resistance: 2695

Support 1: 2640

Support 2: 2528

Look at the STI line chart below, I have the below pivotal levels(close price) on my notes:

Immediate resistance: 2695

Support 1: 2640

Support 2: 2528

Monday, December 12, 2011

Long STX OSV

STX OSV appreas to be a nice long candidate, it had a breakout two weeks ago( refer to my 30th Nov post HERE) tested its support( resistance turn support for triangle pattern breakout) 1.145 and rebounded on Friday, a bullish hammer candle at support.

Support: 1.145

Target 1.255

Stop: 1.12

Support: 1.145

Target 1.255

Stop: 1.12

Friday, December 9, 2011

STI Immediate Support: 2700-2715

Good morning everyone.

STI closed at 2728 yesterday, broke down its important support 2740 level. It's expected it will fade the gap today, my immediate support 2715-2700.

The EU summit resolution today will impact the whole market sentiment.

STI closed at 2728 yesterday, broke down its important support 2740 level. It's expected it will fade the gap today, my immediate support 2715-2700.

The EU summit resolution today will impact the whole market sentiment.

Thursday, December 8, 2011

STI Sank On Opening

STI gave back all its gain yesterday and more, properties leading the dive as government moves to curb housing market by additional buyer's duty(ABSD).

STI's immediate major support is at 2740 is still intact by now, STI -37.61 at 2745, low of the day so far is 2739.95 as at 9.36am. while upside resistance is 2776( 38.2% fibo pull).

STI Support: 2740

STI Resistance: 2776

Talk to you soon.

STI's immediate major support is at 2740 is still intact by now, STI -37.61 at 2745, low of the day so far is 2739.95 as at 9.36am. while upside resistance is 2776( 38.2% fibo pull).

STI Support: 2740

STI Resistance: 2776

Talk to you soon.

Wednesday, December 7, 2011

Market Wrap

Here's a quick market wrap for today, STI closed up by 33.31 to closed at 2782.55, it crossed 2776 (38.2 fibo pull) mark, and broke past four days resistance at 2772 too, a good sign for bulls. Next immediate target for STI is 2810, then 2850. You can feel my cautiousness as the targets are pretty much close. And I think market will watch the EU summit result on this Friday 9th Dec.

As for individual stocks, star performer today is CAO, NOL, YZJ, Mewah and my favorite HKland US$ just 4.82 resistance, more upside are expected.

My long watchlist for tomorrow:

Genting Sp

Soundglobal

Cosco

See you soon.

As for individual stocks, star performer today is CAO, NOL, YZJ, Mewah and my favorite HKland US$ just 4.82 resistance, more upside are expected.

My long watchlist for tomorrow:

Genting Sp

Soundglobal

Cosco

See you soon.

Mewah Breakout

Mewah break its resistance 49c right after opening this morning. showing some buying pressure. It's 51c, up2.5c now. Target is 55-58c.

Tuesday, December 6, 2011

Major Indices Fibo Pull Update

Below table is the summary of world major indices YTD number as compare to their last year closing level. As of 5th Dec, only Dow and Nasdaq better than last year.

SoundGlobal

It's time to make a decision--either up or down, as soundblobal approaching its apex in the triangle formation. It appears to me the odds are slightly bias to upside. let see how it works out.

Friday, December 2, 2011

Uptrend Stocks (updated)

STI recovered it early morning loss and closed positive with 11 points gain, STI clsoed at 2773, the odds is to upside as long STI holds above 2750 support. below is the uptrending stocks(or stocks above 20/50ma) updated by today.

Soundglobal

Kepcorp

Sembcorp

Sembmar

STX OSV

DBS

JArdine C&C

F&N

HKland

Capitaland

Mewah

Goldenagri

FirstRes

Soundglobal

Kepcorp

Sembcorp

Sembmar

STX OSV

DBS

JArdine C&C

F&N

HKland

Capitaland

Mewah

Goldenagri

FirstRes

Wednesday, November 30, 2011

Long Candidates

STI managed to closed above 2700 today. with US market strong rebounce. I have long candidates for tomorrow:

UOL: It hit 61.8% fibo at 4.12 and rebounded. 4.16 is its resistance turn support level, it closed at 4.21.

F&N: Break its major resistance 6.32, next target 6.6.

UOL: It hit 61.8% fibo at 4.12 and rebounded. 4.16 is its resistance turn support level, it closed at 4.21.

F&N: Break its major resistance 6.32, next target 6.6.

OUE: at Triple bottom support level 2.0 by closing today.

Cache

GLP

STX OSV: Confirmed Break Triangle , target 1.265

STI Under Downside Pressure

STI has tested 2700 resistance yesterday but failed to stay above it, it closed at 2688 in the end. 2700 is the support turn to resistance level now. My bias is to downside more than upside unless STI climb above 2720(gap). STI may go down to test 2605 support level if it continue down.

Tuesday, November 29, 2011

How the German Bailout Greek

It is a slow day in a little Greek Village . The rain is beating down and the streets are deserted. Times are tough, everybody is in debt, and everybody lives on credit.

On this particular day a rich German tourist is driving through the village, stops at the local hotel and lays a €100 note on the desk, telling the hotel owner he wants to inspect the rooms upstairs in order to pick one to spend the night.

The owner gives him some keys and, as soon as the visitor has walked upstairs, the hotelier grabs the €100 note and runs next door to pay his debt to the butcher.

The butcher takes the €100 note and runs down the street to repay his debt to the pig farmer.

The pig farmer takes the €100 note and heads off to pay his bill at the supplier of feed and fuel.

The guy at the Farmers' Co-op takes the €100 note and runs to pay his drinks bill at the taverna.

The publican slips the money along to the local prostitute drinking at the bar, who has also been facing hard times and has had to offer him "services" on credit.

The hooker then rushes to the hotel and pays off her room bill to the hotel owner with the €100 note.

The hotel proprietor then places the €100 note back on the counter so the rich traveller will not suspect anything.

At that moment the traveller comes down the stairs, picks up the €100 note, states that the rooms are not satisfactory, pockets the money, and leaves town.

No one produced anything. No one earned anything. However, the whole village is now out of debt and looking to the future with a lot more optimism.

And that, Ladies and Gentlemen, is how the bailout package works.

On this particular day a rich German tourist is driving through the village, stops at the local hotel and lays a €100 note on the desk, telling the hotel owner he wants to inspect the rooms upstairs in order to pick one to spend the night.

The owner gives him some keys and, as soon as the visitor has walked upstairs, the hotelier grabs the €100 note and runs next door to pay his debt to the butcher.

The butcher takes the €100 note and runs down the street to repay his debt to the pig farmer.

The pig farmer takes the €100 note and heads off to pay his bill at the supplier of feed and fuel.

The guy at the Farmers' Co-op takes the €100 note and runs to pay his drinks bill at the taverna.

The publican slips the money along to the local prostitute drinking at the bar, who has also been facing hard times and has had to offer him "services" on credit.

The hooker then rushes to the hotel and pays off her room bill to the hotel owner with the €100 note.

The hotel proprietor then places the €100 note back on the counter so the rich traveller will not suspect anything.

At that moment the traveller comes down the stairs, picks up the €100 note, states that the rooms are not satisfactory, pockets the money, and leaves town.

No one produced anything. No one earned anything. However, the whole village is now out of debt and looking to the future with a lot more optimism.

And that, Ladies and Gentlemen, is how the bailout package works.

Long Candidate

STX OSV

STX OSV forming a triangle, its horizontal support 1.13 already broken, the odds is to upside, with first target 1.18( 61.8%)

STX OSV forming a triangle, its horizontal support 1.13 already broken, the odds is to upside, with first target 1.18( 61.8%)

Monday, November 28, 2011

Uptrending Stocks(updated)

As market rebounding on "good news" from Europe( market is fluctuating on the headlines still). It's relatively safer to consider the uptrending stocks for rebounce.

Uptrending stocks:

GLP

STX OSV

GoldenAgri

Firstresources

Biosensor

Mewah

Yanlord

F&N

Jardine c&c

Uptrending stocks:

GLP

STX OSV

GoldenAgri

Firstresources

Biosensor

Mewah

Yanlord

F&N

Jardine c&c

The Market Outlook

Good morning everyone. Hope you had a great weekend. I went to Semakau Island over the weekend-- A small island of Singapore which you have to apply entry permit, it was a great experience. Nice ocean view and sightseeing.

S&P 500 had two weeks down in a row, it's formed a small inverted hammer last Friday on it's 61.8% fibonacci level(support). The market is weak and the drop is overly extented. The major support is 1120 for S&P 500--another 40 points away from Friday's close.

STI is rather weaker as compare to SPX-- four weeks down in a row, and broke below its 61.8% fibonacci level last Friday, much weaker as compared to SPX. I always wondering where the real crisis is. Asian market such as Hang Seng and Shanghai are much weak too, Shanghai market is one of the worst market world wide this year, probably better than Greece only.

STI current support level I'm watching is 2640( switch your chart to line chart to see). if 2640 can be hold, then it going to test the long tails on STI weekly chart, the low is 2520.

S&P 500 had two weeks down in a row, it's formed a small inverted hammer last Friday on it's 61.8% fibonacci level(support). The market is weak and the drop is overly extented. The major support is 1120 for S&P 500--another 40 points away from Friday's close.

STI is rather weaker as compare to SPX-- four weeks down in a row, and broke below its 61.8% fibonacci level last Friday, much weaker as compared to SPX. I always wondering where the real crisis is. Asian market such as Hang Seng and Shanghai are much weak too, Shanghai market is one of the worst market world wide this year, probably better than Greece only.

STI current support level I'm watching is 2640( switch your chart to line chart to see). if 2640 can be hold, then it going to test the long tails on STI weekly chart, the low is 2520.

Thursday, November 24, 2011

Kim Eng Recovery Portfolio 2012

Refer to Kim Eng Research "Power Bites" today's report, I want to keep a copy here for reference, among the nine blue chips it recommended, I'm particularly interested in Capitaland, which shows its latest book value is 3.29, where it's current price is 2.51(4.05pm), this morning it traded to as low of 2.43. recent low is at 2.28 on Oct 4, the lowest price since 2008 Financial Crisis is 1.7 on Mar 3, 2009.

Technically, Capitaland is in a nice downtrend channel, I will consider a bottom fishing only when it touched the bottom line of its channel, or breakout above its upper line, which has yet happened now.

Technically, Capitaland is in a nice downtrend channel, I will consider a bottom fishing only when it touched the bottom line of its channel, or breakout above its upper line, which has yet happened now.

The Survival (uptrend)

STI hit its 38.2% fibonacci level at 2668, this morning opened gap lower to low of 2660 and rebounding closed the gap now(10.11am), STI +4points at 2681(10.11am).

The survivals after this crash down are listed below, what I mean by "survival" is the stocks uptrend is still intact( or still above their 50ma), and under my list for a quick rebounce.

Sound global

Sembcorp

Kepcorp

Sembmar

STX OSV

F&N

Yanlord( at 20ma support now)

First resource

Mewah

Golden Agri

Biosensor

The survivals after this crash down are listed below, what I mean by "survival" is the stocks uptrend is still intact( or still above their 50ma), and under my list for a quick rebounce.

Sound global

Sembcorp

Kepcorp

Sembmar

STX OSV

F&N

Yanlord( at 20ma support now)

First resource

Mewah

Golden Agri

Biosensor

Wednesday, November 23, 2011

STI Losing 2694 Key Support

STI did not continue its rebounce as I expected, the US bank test adds to bank woes(click here). The three local banks has dropped more than 1.5% as I'm writing now. DBS dropped to its three weeks low.

As a key pivot level, STI is losing 2694 support. The uptrend is over if it closed below this level today.

As a key pivot level, STI is losing 2694 support. The uptrend is over if it closed below this level today.

Tuesday, November 22, 2011

Long Candidates

It's 4.47pm, STI +18 at 2715. I see market is rebounding. The stocks forming reversal patterns are:

Olam

Noble

DBS

Mewah

Sembmar

Genting Sp

Olam

Noble

DBS

Mewah

Sembmar

Genting Sp

STI Pivot Point 2694

STI hit its one month low yesterday(new low), the chart doesn't look so good. It crossed its 50% fibo level 2713 yesterday, and next fibo level at 2668.

Looking at overall trend from Oct 5, STI hit new low at 2521 then rebounded to high of 2905 on 28 Oct, the uptrend is still intact so far, pivot point will be at 2694, if STI CLOSED below 2694, I would consider the uptrend is violated.

Looking at overall trend from Oct 5, STI hit new low at 2521 then rebounded to high of 2905 on 28 Oct, the uptrend is still intact so far, pivot point will be at 2694, if STI CLOSED below 2694, I would consider the uptrend is violated.

Monday, November 21, 2011

STI Supported at 2700

STI hit its one month low 2698 in the morning and rebounding, it's trading at 2720 now(3.03pm).

I see limited downside for STI after recent drop-off. Many blue chips are under my radar long candidate.

Below are the counters with their support level:

DBS: 12.33

Sembmar: 3.8

GLP: 1.77

Capitaland: 2.55

I see limited downside for STI after recent drop-off. Many blue chips are under my radar long candidate.

Below are the counters with their support level:

DBS: 12.33

Sembmar: 3.8

GLP: 1.77

Capitaland: 2.55

Friday, November 18, 2011

T.G.I.F

It's enough for the week's boredom, T.G.I.F. STI has been doing nothing but grinding aound 2780-2840. It finally CLOSED below 2780 yesterday, after few intra-day attempts.

My next support for STI is 2720-2745( gap support area). The bulls is still struggling to stand on the scene. This area may spur some buying interest.

My next support for STI is 2720-2745( gap support area). The bulls is still struggling to stand on the scene. This area may spur some buying interest.

Thursday, November 17, 2011

Lottery Play

It's been long time since my last "lottery" play candidates, which I mean they are typically below 50c in price, high risk and volotile.

Below are the two of them:

Mewah 50c

Gallant 28.5c

Below are the two of them:

Mewah 50c

Gallant 28.5c

2780 key Support level Still Intact

STI came down tested 2780 support and rebounded to close 2807 yesterday, and it opened today(gap down) at 2780, AGAIN. 4th time since it broke the resistance level on 27th Oct.

Overall, market is trading in a sideway manner, also an "insideweek" within last week range. It's rather frustrating. To show me some bullishness, it should at least climb above 2810 today. Otherwise, a same inside day again.

Overall, market is trading in a sideway manner, also an "insideweek" within last week range. It's rather frustrating. To show me some bullishness, it should at least climb above 2810 today. Otherwise, a same inside day again.

Wednesday, November 16, 2011

STI at 2780 Support. Again.

STI 2779,-32 points(2.57pm), it opened gap up to 2830 and all the way down to fill the gap in between 2790-2827( Friday and Mon). Everywhere looks frustrating, HSI lost 520 points and lost 71 points so far.

Today's big red candle looks pretty bearish. If 2780 lost, we would see more downside ahead.

Today's big red candle looks pretty bearish. If 2780 lost, we would see more downside ahead.

Tuesday, November 15, 2011

It's Gaps Here and There

While I'm still bias to upside more than downside in longer time frame, it becomes a little bit more trickier to trade in the short time frame--the gaps( up and downs) are just around here and there. The suddenly up and down are mainly driven by the headlines.I expect it will be continue like this for a while. Technically speaking, it's sideway trading in the range of 2780-2900. While don't forget the "benchmark" 2855 (50%) line is in sight, STI is 2827 now(9.44am).

The banks are giving me divergence signals--DBS and OCBC look bullish to me, while UOB looks bearish.

My "neutral" range for STI today is 2840-2810. See how it goes.

The banks are giving me divergence signals--DBS and OCBC look bullish to me, while UOB looks bearish.

My "neutral" range for STI today is 2840-2810. See how it goes.

Monday, November 14, 2011

Market Set to Open Higher

Since STI did break-out its head and shoulder pattern first time on 27th Oct, it has been effectively trapping in between 2780-2900, where 2780 (the neckline) has been working well as support. It closed at 2790 last Friday, the the Dow recovering 260 points, we are due for rotation upwards now.

Long candidates:

Kepcorp

Sembcorp/marine

DBS

Capitaland

GLP

Long candidates:

Kepcorp

Sembcorp/marine

DBS

Capitaland

GLP

Friday, November 11, 2011

The Bulls Are Still in Domination

Good morning everyone, STI had a intraday drop below 2780 yesterday and managed to close above it on closing. STI uptrend still intact. My long candidates with their support level are as below:

CWT: 1.03

Swiber: 0.579

Sembcorp: 4.03

DBS: 12.33

Mewah: 0.465

CWT: 1.03

Swiber: 0.579

Sembcorp: 4.03

DBS: 12.33

Mewah: 0.465

Thursday, November 10, 2011

The Vulnerable Bulls

The Greece problem not yet fixed, now it's the Italy's turn. Dow dropped 389.24 to closed at 11780.94 last night, more than 3% drop. How low STI can go for today? A nice level to expect would be 2780, 78 points down from yesterday close, which is the neckline of the inverse head & shoulder pattern, also the 38.2% Fibonacci level( 100% at 3190, low is 2523).

Wednesday, November 9, 2011

Long Candidates

Good morning everyone. It was a great long weekend. Anyway, I'm back into action.

The commodities sector looks especially bullish to me. My long candidates:

Indoagri

Olam

Noble

Wilmar

Mewah

and also:

CWT

Sembcorp/marine

Yanlord

The commodities sector looks especially bullish to me. My long candidates:

Indoagri

Olam

Noble

Wilmar

Mewah

and also:

CWT

Sembcorp/marine

Yanlord

Friday, November 4, 2011

Looking For Long Weekend Ahead

STI is currently trading at 2857, two points above the 50% level 2855,(pivot points I posted few 1 Nov, click HERE). Trading is all about numbers and levels, amazing.

I'm bullish if STI can CLOSE above 2855.

I'm leaving for my long weekend holiday now, most likely I will update you again on Wed.

Have a nice weekend ahead.

I'm bullish if STI can CLOSE above 2855.

I'm leaving for my long weekend holiday now, most likely I will update you again on Wed.

Have a nice weekend ahead.

Long Candidates

US market was up by 208 points to closed at 12044 last night, it will add some upbeat momentum to STI today.

STI has completed probably will end its consolidation after its break-out from its inverse head and shoulder pattern.

I see STI will resume its upside move, with next target is 2900 and 3010. Support level is the neckline 2780.

Long Candidates:

DBS( 12.33 support)

Genting Sp

SIA Engg( dividend play, xd 6c on 11 Nov)

Indoagri

Noble grp

Kepcorp

Sembcorp

Sembmar

Wilmar

STI has completed probably will end its consolidation after its break-out from its inverse head and shoulder pattern.

I see STI will resume its upside move, with next target is 2900 and 3010. Support level is the neckline 2780.

Long Candidates:

DBS( 12.33 support)

Genting Sp

SIA Engg( dividend play, xd 6c on 11 Nov)

Indoagri

Noble grp

Kepcorp

Sembcorp

Sembmar

Wilmar

Thursday, November 3, 2011

STI Testing 2780 Support Again

STI is not as bullish as I expected. It forms an inside bar instead, was contained within yesterday's trading range.

The US dow futures dropped 152 points at 11616, and FTSE dropped 86 points to 5396, as I'm writing now(3.48pm), put much downside pressure on STI.

STI yesterday gaped down below 2780 yesterday on open and rebounded above it, today it gaped down again at open, and from 2801driftingdown towards 2780support( 2780 is the neckline) ,thus if 2780 can't be hold, I will have to change my bullish view to bearish.

The US dow futures dropped 152 points at 11616, and FTSE dropped 86 points to 5396, as I'm writing now(3.48pm), put much downside pressure on STI.

STI yesterday gaped down below 2780 yesterday on open and rebounded above it, today it gaped down again at open, and from 2801driftingdown towards 2780support( 2780 is the neckline) ,thus if 2780 can't be hold, I will have to change my bullish view to bearish.

Bulls Regain Its Power

STI has tested its head-and shoulder breakout point--the neckline yesterday and rebounded, and we have a bullish engulfing pattern on STI daily chart. The bulls seem gain its power again, though couple of big events--the Greece Crisis and US economy concerns are always "renew" itself on headline from time to time. And we got new crisis-- the MF global bankruptcy, as it was linked to then Lehman brother effect...

We are in a messed situation now and it seems it won't be ending anytime soon. Given such situation, I will focus on identifying which side got more power( bull or bears) and follow the winner. Act like a Guerrilla.

For STI, if it can stay above its previous "pivot" point 2855(50% Fibonacci level), the bulls will "reiterate" its power.

We are in a messed situation now and it seems it won't be ending anytime soon. Given such situation, I will focus on identifying which side got more power( bull or bears) and follow the winner. Act like a Guerrilla.

For STI, if it can stay above its previous "pivot" point 2855(50% Fibonacci level), the bulls will "reiterate" its power.

Wednesday, November 2, 2011

Long Candidate

STI fully covered its early morning loss and turns to positive now, +2 points at 2792, i see many blue chips are retraced to their 20/50ma support and rbounding now. A good chance to buy "low".

Below are my long candidates with plenty of room to upside, with their support level,:

Noble at 1.50, 20/50ma support

Sembcorp 4.0

Sembmar 3.8

DBS 12.0

SIA 11.3

Cosco 1.0

Genting 1.65

Below are my long candidates with plenty of room to upside, with their support level,:

Noble at 1.50, 20/50ma support

Sembcorp 4.0

Sembmar 3.8

DBS 12.0

SIA 11.3

Cosco 1.0

Genting 1.65

STI Immediate Support:the Neckline 2778

This is a trader's market, if you were long last week when market break out and soared to upside, you probably made a stunning paper profit within few days, but if you didn't take profit when market turned down. You will back to square one by yesterday, or today.

Dow's support: 11577 (2010 close)

STI immediate support will be the neckline it broke out last Thursday: 2778, we have 20 and 50ma just below this level as well. the next support will be 2695.

will update you again.

Dow's support: 11577 (2010 close)

STI immediate support will be the neckline it broke out last Thursday: 2778, we have 20 and 50ma just below this level as well. the next support will be 2695.

will update you again.

Tuesday, November 1, 2011

STI Support 2820-2778

STI dropped 50points to closed at 2855 level, which is exactly its 50% level to year 2010 close. As US market retraced last night, STI is down 36 points at 2820( 9.31am) as I'm writing this.

Uptrend is intact for the major US indices, the major benchmark level( or rather pivot point for uptrend) I'm looking at are as below, ( the "50% level"):

Uptrend is intact for the major US indices, the major benchmark level( or rather pivot point for uptrend) I'm looking at are as below, ( the "50% level"):

STI support area will be at 2820-2778(the previous breakout level where market started its run-up).

I'm looking for buy-on-dip once its retracement completed.

Monday, October 31, 2011

Market Facing Immediate Resistance 2900

Good morning everyone.

Profit-taking taking place after its last week surge up. STI is down 23 point at 2882. STI facing immediate resistance at 2900, support level 2850, then 2790. It offers some "buy on dip" opportunities for the bulls.

As the trend is up, I will focus more on "buying"(long) rather than "selling"(short). I expect STI would continue its run up towards the end of this year.

Will update you soon.

Profit-taking taking place after its last week surge up. STI is down 23 point at 2882. STI facing immediate resistance at 2900, support level 2850, then 2790. It offers some "buy on dip" opportunities for the bulls.

As the trend is up, I will focus more on "buying"(long) rather than "selling"(short). I expect STI would continue its run up towards the end of this year.

Will update you soon.

Friday, October 28, 2011

STI Resistance 2900-2935

Coming to last trading day of the week, remember the special Friday indicator? Some of the statistics:

50% is at 2857, and 61.8% is at 2935.

50% is at 2857, and 61.8% is at 2935.

Long Candidates

Good morning everyone. STI went up 77 points to close at 2847 yesteday. I see a lot of room to the upside, a market rally like yesterday is unsual, but it will happen once in a while when most people don't believe it.

Below are my long candidates which just breakout their resistance or ready to fly( possible today?)

with resistance level

DBS: broke resistance 12.33, target 13.8

OCBC: broke resistance 8.4, target 9.12

CWT 1.03

ARA 1.305

Hyflux

Ezra 99.5c

HPH 68c

SIA 11.45

YZJ 96.5c

Below are my long candidates which just breakout their resistance or ready to fly( possible today?)

with resistance level

DBS: broke resistance 12.33, target 13.8

OCBC: broke resistance 8.4, target 9.12

CWT 1.03

ARA 1.305

Hyflux

Ezra 99.5c

HPH 68c

SIA 11.45

YZJ 96.5c

Thursday, October 27, 2011

Bulls are Back

Another 6 minutes to 5pm, STI has soared up to as high as 2862, or nearly 100 points intraday today. currently around 2850 level. 50% market for STI to "go home"( 2010 close) is at 2857 level. We have an inverted Head and Shoulder pattern on STI chart with the neckline is 2780, the target is 3027.

Note the target is in middle to long term. Do not expect it to be achieved very soon. In short term wise, 2857 is the immediate resistance level to watchout, we could see further upside if it cross and stay above this level.

Note the target is in middle to long term. Do not expect it to be achieved very soon. In short term wise, 2857 is the immediate resistance level to watchout, we could see further upside if it cross and stay above this level.

Stocks Set up for More Upside

As STI breaking out its one month high 2789 today( 2805 now), The momentum is obviously bullish. I see many stocks starting to break their major resistance levels and formed a HIGHER HIGH and HIGHER LOW today. It marks a change in the trend, which including STI.

Below are those stocks under my radar which formed HH and HL or crossed both their 20and 50dma:

Genting SP

HL Aisa

Kepcorp

Sembcorp

Sembmar( above 20/50ma)

Cosco(above 20/50ma)

Swiber

CAO(at support 95c now)

Ezra(above 20/50ma)

DBS

Jardine C&C

SIA

Singtel

Citydev

F&N

Capitaland(above 20/50ma)

OUE

Yanlord

CapitaMall

Indoagri

Olam

Noble

FirstRes

GoldenAgri

GLP

ChinaAnimal health

Sunvic

SoundGlobal

Biosensor

Osim

DO NOT chase if the stocks already run up high, do your preparation and wait for a retracement to enter.

Below are those stocks under my radar which formed HH and HL or crossed both their 20and 50dma:

Genting SP

HL Aisa

Kepcorp

Sembcorp

Sembmar( above 20/50ma)

Cosco(above 20/50ma)

Swiber

CAO(at support 95c now)

Ezra(above 20/50ma)

DBS

Jardine C&C

SIA

Singtel

Citydev

F&N

Capitaland(above 20/50ma)

OUE

Yanlord

CapitaMall

Indoagri

Olam

Noble

FirstRes

GoldenAgri

GLP

ChinaAnimal health

Sunvic

SoundGlobal

Biosensor

Osim

DO NOT chase if the stocks already run up high, do your preparation and wait for a retracement to enter.

Tuesday, October 25, 2011

STI One Month High 2789

STI is quite close to its one month high at 2789, I see more upside potential IF it can break and CLOSE above this level. STI has travelled "extent" enough high so far, I'd prefer to buy on dip rather than chase the high--if you have yet to buy. Or you can take this opportunities to take profit on your long positions. On the downside, 2745-2720(gap) will be support level to watch out. 2789 is the key resistance level.

Monday, October 24, 2011

Long Candidates

Long candidates under my radar for upside move by sectors"

Oil & Gas Offshore:

ChinaAoil

Sembmar

Cosco

Ezra

Financial/STI component:

SGX

Jardine

Venture

Singtel

Property:

HKland

CapitMall

Commodities:

Noble

wilmar

Oil & Gas Offshore:

ChinaAoil

Sembmar

Cosco

Ezra

Financial/STI component:

SGX

Jardine

Venture

Singtel

Property:

HKland

CapitMall

Commodities:

Noble

wilmar

Market is Set for Upside Move

Good morning everyone, hope you all had a nice weekend. Coming to this week, we have lots of "hopes" for the market to move up.

Dow Jones shows a clear breakout to upside on Friday close. It finally had a move out from its large congested area over past two months time, give us a rather strong "bottom".

Local benchmark STI was stuck in the range" 2700-2715" area--an inside-bar of Thursday candlestick. Furtherer upside shall be seen if it can break above 2715 resistance.

Dow Jones shows a clear breakout to upside on Friday close. It finally had a move out from its large congested area over past two months time, give us a rather strong "bottom".

Local benchmark STI was stuck in the range" 2700-2715" area--an inside-bar of Thursday candlestick. Furtherer upside shall be seen if it can break above 2715 resistance.

Friday, October 21, 2011

Short: First Resources

FirstRes has rebounded all the way up to its major resistance at 1.36. A nice shorting candidate with stop loss at 1.375.

Singapore Property Stocks

The properties stock listing in Singapore has generally dropped quite a lot, some are way below their NAV/NTA. You may keep monitoring if you are looking for "value investment". Refer to the table below:

Thursday, October 20, 2011

In Selling Mode

Kind of boring day for me...scratching my head on what to write.

STI broke its 2715 support and also closed below 2700 marginally today, down 26points at 2694.

It turned to bearish today, but I don't see aggressive selling come in yet. 2715 becomes its immediate resistance and 2670 become the last defence for bulls tomorrow.

Bye for now.

STI broke its 2715 support and also closed below 2700 marginally today, down 26points at 2694.

It turned to bearish today, but I don't see aggressive selling come in yet. 2715 becomes its immediate resistance and 2670 become the last defence for bulls tomorrow.

Bye for now.

STI Trapped Between 2715-2750

STI formed a inside bar yesterday, it basically was trapped within my set of "boundary" 2715-2750, we only get clear direction when it trades beyond this range. Otherwise, have to be patiently wait..., anyway, 2715 provides a decent support for the time being.

Will update you again.

Will update you again.

Wednesday, October 19, 2011

Subscribe to:

Posts (Atom)