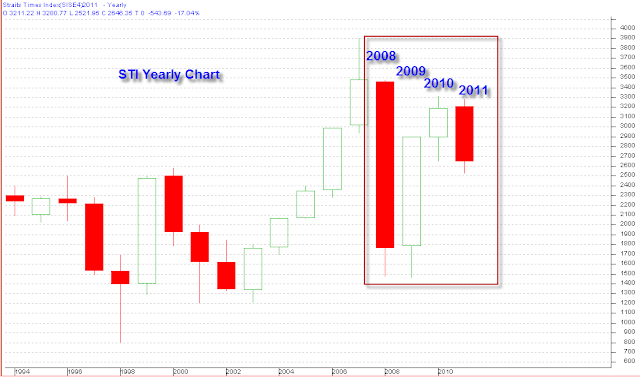

The end of year window dressing did not happen at all as expected. STI closed 26 points down at 2646.35 today. That's the 2011 year end close figure for STI. As for the whole year, STI dropped 543.69 points or 17%.worst year since 2008 financial crisis.

For a trader, winning is extremly dangerous if you haven't learned how to monitor and control yourself.

The Secret Recipe: Trading Success = Winning Trading System - U

The Secret Recipe: Trading Success = Winning Trading System - U

Friday, December 30, 2011

Last Day to Close 2011

Good morning.

It's our last trading day today to close book. STI managed to close higher yesterday at 2672.78, up by 6.53points. Slightly above its 61.8% fibo level at 2669. The trading volume has picked up slightly as well. The next fibo level in sight is 50% at 2714, which is its downtrend line resistance level. With US market up by 135 points last night, I'm watching STI for a rebounce today with upside capped at 2715.

It's our last trading day today to close book. STI managed to close higher yesterday at 2672.78, up by 6.53points. Slightly above its 61.8% fibo level at 2669. The trading volume has picked up slightly as well. The next fibo level in sight is 50% at 2714, which is its downtrend line resistance level. With US market up by 135 points last night, I'm watching STI for a rebounce today with upside capped at 2715.

Wednesday, December 28, 2011

STI Update

Goood morning everyone. I just came back Singapore four hours ago in this morning. A enjoyful holiday for me. Hope you all had a great Christmas too.

We have three more days to close book of 2011. Market is still trapped within 2670-2680, the whole market volume is very thin-- 370m for yesterday only( compare to normal 1.1B). Market is quiet ahead of New Year.

Look at chart below, STI is just above 61.8% 2668, it may test 50% at 2714 level in coming days, a pretty much short rebounce is expected but nothing much higher, for now.

We have three more days to close book of 2011. Market is still trapped within 2670-2680, the whole market volume is very thin-- 370m for yesterday only( compare to normal 1.1B). Market is quiet ahead of New Year.

Look at chart below, STI is just above 61.8% 2668, it may test 50% at 2714 level in coming days, a pretty much short rebounce is expected but nothing much higher, for now.

Friday, December 23, 2011

Merry Christmas

Merry Xmas to all my dear readers.

The market trading volume is extremely thin these days approaching holiday season. The average trading volume on the whole market is about 450m from the normal 1.1b... Anyway I'm going out of town later for my holiday and will be only update you on 28th Dec again. See ya.

The market trading volume is extremely thin these days approaching holiday season. The average trading volume on the whole market is about 450m from the normal 1.1b... Anyway I'm going out of town later for my holiday and will be only update you on 28th Dec again. See ya.

Thursday, December 22, 2011

ChinaAoil

A dimond in the rough? ChinaAoil ( CAO) has broken its long term downtrend line (blue line, see below chart.)

Major support is 97.5c, which is above its 20ma and 50ma as well. The chart looks nice, good entry point will be at 97.5c to 98.5c.

Major support is 97.5c, which is above its 20ma and 50ma as well. The chart looks nice, good entry point will be at 97.5c to 98.5c.

Long candidate: Genting SP

Genting Sp well supported by its 20ma at 1.52 with bullish MACD and increasing volume.

Current price at 1.53, near term target 1.62( gap). Stop loss: 1.48.

Current price at 1.53, near term target 1.62( gap). Stop loss: 1.48.

Wednesday, December 21, 2011

STI Outlook

Last night Dow up by 337.3 points to closed at 12103, regain control over 12000. STI has dropped to near 2600 since it broke its uptrend line. It likely to rebound to test the level at 2670-2694 area again in coming days. Christmas rally to come?

kepcorp

Sembmar

CAO

Goldenagri

NOL

Monday, December 19, 2011

STI Outlook Gloomy

Good morning everyone. Sorry for my inactive in updating my blog last few days. I'm a bit of annoyed by the bearishness of the market. And I can't short it due to the temporary unavailable of CFD trading, the good news is Kim Eng is taking the opportunity to fully revamping the CFD platform and is expected to start brand new in year 2012.

In any case, Christmas is just on the corner and we have two weeks to end the year 2011. Are we going to have a rally towards year end? The odds seem getting slim. So far the market looks still weak, look at the chart below, STI triangle uptrend line has been broken, the 61.8% fib support level 2668 also been broken at the same time. On last Thursday it actually did gap down below this level, and managed to had a rebounce to filled the gap( Friday's high is 2667.38), 2668 support turns to resistance level now.

For this week, I'm watching 2640 as STI's immediate support closely, once it closed below 2640, more downside shall come.

In any case, Christmas is just on the corner and we have two weeks to end the year 2011. Are we going to have a rally towards year end? The odds seem getting slim. So far the market looks still weak, look at the chart below, STI triangle uptrend line has been broken, the 61.8% fib support level 2668 also been broken at the same time. On last Thursday it actually did gap down below this level, and managed to had a rebounce to filled the gap( Friday's high is 2667.38), 2668 support turns to resistance level now.

For this week, I'm watching 2640 as STI's immediate support closely, once it closed below 2640, more downside shall come.

Wednesday, December 14, 2011

STI on the Edge of Cliff

Take a look at STI chart below, it's now cycling down to its triangle bottom line, I'm bearish if STI can't CLOSE above 2715( 50% Fib level), more down side if it closed below the triangle bottom line, "last straw" is at 2668( 61.8% fib).

Look at the STI line chart below, I have the below pivotal levels(close price) on my notes:

Immediate resistance: 2695

Support 1: 2640

Support 2: 2528

Look at the STI line chart below, I have the below pivotal levels(close price) on my notes:

Immediate resistance: 2695

Support 1: 2640

Support 2: 2528

Monday, December 12, 2011

Long STX OSV

STX OSV appreas to be a nice long candidate, it had a breakout two weeks ago( refer to my 30th Nov post HERE) tested its support( resistance turn support for triangle pattern breakout) 1.145 and rebounded on Friday, a bullish hammer candle at support.

Support: 1.145

Target 1.255

Stop: 1.12

Support: 1.145

Target 1.255

Stop: 1.12

Friday, December 9, 2011

STI Immediate Support: 2700-2715

Good morning everyone.

STI closed at 2728 yesterday, broke down its important support 2740 level. It's expected it will fade the gap today, my immediate support 2715-2700.

The EU summit resolution today will impact the whole market sentiment.

STI closed at 2728 yesterday, broke down its important support 2740 level. It's expected it will fade the gap today, my immediate support 2715-2700.

The EU summit resolution today will impact the whole market sentiment.

Thursday, December 8, 2011

STI Sank On Opening

STI gave back all its gain yesterday and more, properties leading the dive as government moves to curb housing market by additional buyer's duty(ABSD).

STI's immediate major support is at 2740 is still intact by now, STI -37.61 at 2745, low of the day so far is 2739.95 as at 9.36am. while upside resistance is 2776( 38.2% fibo pull).

STI Support: 2740

STI Resistance: 2776

Talk to you soon.

STI's immediate major support is at 2740 is still intact by now, STI -37.61 at 2745, low of the day so far is 2739.95 as at 9.36am. while upside resistance is 2776( 38.2% fibo pull).

STI Support: 2740

STI Resistance: 2776

Talk to you soon.

Wednesday, December 7, 2011

Market Wrap

Here's a quick market wrap for today, STI closed up by 33.31 to closed at 2782.55, it crossed 2776 (38.2 fibo pull) mark, and broke past four days resistance at 2772 too, a good sign for bulls. Next immediate target for STI is 2810, then 2850. You can feel my cautiousness as the targets are pretty much close. And I think market will watch the EU summit result on this Friday 9th Dec.

As for individual stocks, star performer today is CAO, NOL, YZJ, Mewah and my favorite HKland US$ just 4.82 resistance, more upside are expected.

My long watchlist for tomorrow:

Genting Sp

Soundglobal

Cosco

See you soon.

As for individual stocks, star performer today is CAO, NOL, YZJ, Mewah and my favorite HKland US$ just 4.82 resistance, more upside are expected.

My long watchlist for tomorrow:

Genting Sp

Soundglobal

Cosco

See you soon.

Mewah Breakout

Mewah break its resistance 49c right after opening this morning. showing some buying pressure. It's 51c, up2.5c now. Target is 55-58c.

Tuesday, December 6, 2011

Major Indices Fibo Pull Update

Below table is the summary of world major indices YTD number as compare to their last year closing level. As of 5th Dec, only Dow and Nasdaq better than last year.

SoundGlobal

It's time to make a decision--either up or down, as soundblobal approaching its apex in the triangle formation. It appears to me the odds are slightly bias to upside. let see how it works out.

Friday, December 2, 2011

Uptrend Stocks (updated)

STI recovered it early morning loss and closed positive with 11 points gain, STI clsoed at 2773, the odds is to upside as long STI holds above 2750 support. below is the uptrending stocks(or stocks above 20/50ma) updated by today.

Soundglobal

Kepcorp

Sembcorp

Sembmar

STX OSV

DBS

JArdine C&C

F&N

HKland

Capitaland

Mewah

Goldenagri

FirstRes

Soundglobal

Kepcorp

Sembcorp

Sembmar

STX OSV

DBS

JArdine C&C

F&N

HKland

Capitaland

Mewah

Goldenagri

FirstRes

Subscribe to:

Posts (Atom)